Still, an IPO of that size is so rare in Europe that it can defy the broader market slump, with portfolio managers forced to take a hard look at the candidate because it will automatically enter the region’s main equity benchmarks, the people said.

While VW did not provide specific numbers or a valuation target in the meetings in Europe and the US, fund managers who attended were left with a positive impression about the brand’s potential to lift margins in the medium term, the people said. Porsche is holding a capital markets day Monday where it could map out a renewed profit push.

Small free float

But several fund managers remain concerned about Porsche’s small free float of 12.5 per cent, and a dual-class share structure that leaves little room for greater managerial independence.

VW plans to sell a stake of as much as 25 per cent of preferred shares that do not carry voting rights. The powerful billionaire Porsche and Piech clan, which controls VW through voting stock, would receive a special dividend to fund buying a blocking minority stake in Porsche.

Porsche’s managers “presented their strategy to taking the company forward very well,” said Simon Jaeger, a portfolio manager at Flossbach von Storch. Still, he cautioned that the planned ownership structure is poised to weigh on the company’s valuation.

Investors have in the past blamed VW’s convoluted governance structure for its sub-par stock-market performance. VW’s preferred shares have dropped around a quarter of this year, valuing the entire company – which also includes Audi, Lamborghini and Bentley – at roughly €80 billion.

VW has been pushing for years to become more nimble but success has been limited. A listing of Traton SE, VW’s truck making unit, fizzled amid internal ructions and a small free float. The firm’s shares have almost halved since the 2019 IPO.

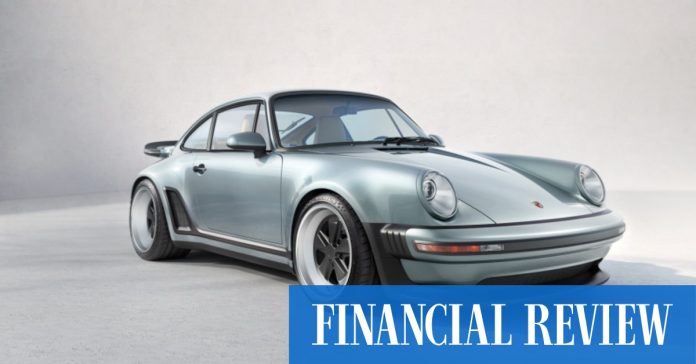

The early IPO meetings were held in Frankfurt, London, New York and Boston, one of the people said, adding that some investors were given a tour of a plant where Porsche assembles the Taycan – an EV that outsold the iconic 911 last year. The manufacturer is also preparing to launch a battery-powered version of its popular Macan SUV to take on Tesla’s Model Y.

Porsche “is the closest legacy brand to Tesla in terms of electrification,” Bloomberg Intelligence analyst Michael Dean said in a note this week. “It will be a key competitor to Tesla in 2023.”

Bloomberg